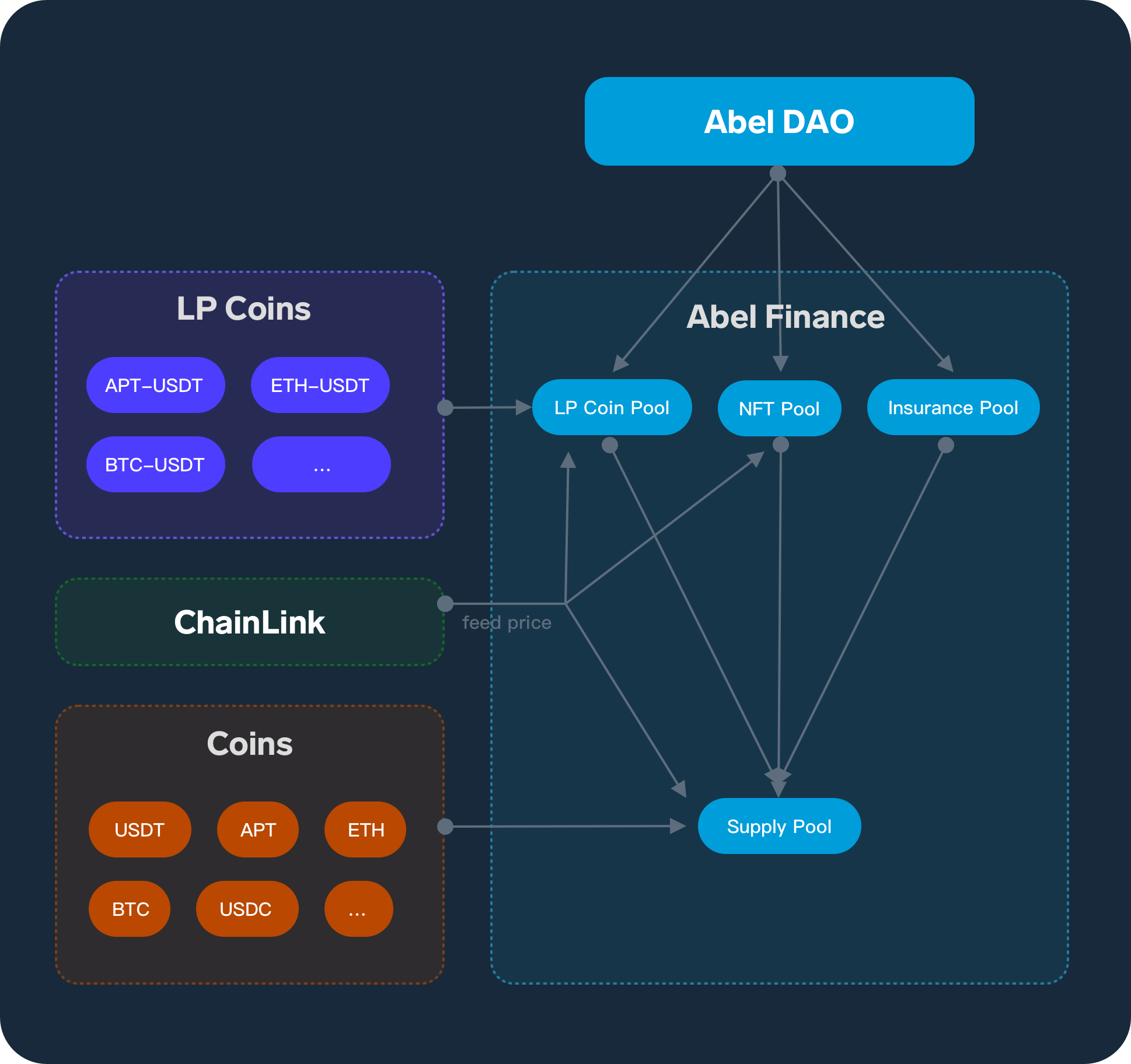

Protocol Overview

Set up 4 capital pools:

1. LP Coins pool (support mainstream LP Coin)

2. Supply pool (support mainstream Coin)

3. Insurance pool (Fund from Abel finance treasury)

4. NFT Pool

The Main Roles Involved

1. LP pledger (borrower):

Deposit LP to obtain credit, use credit to borrow assets (similar to Aave and Compound)

Support mainstream LP pledge

Access principle, new LP Coin currency for governance voting

Rights and Interests

Pledge to obtain credit

Different LPs have different excess borrowing rates

Can be dynamically adjusted

Pledged airdrop incentives

2. Liquidity Provider (Lender)

Deposit token to provide liquidity into the market

Support mainstream Coin

Rights and interests

Interest income from borrowing

Additional liquidity provides incentives

3. Liquidator

When the borrower reaches the liquidation line, the liquidator repays the borrower to obtain the Coin(LP Coin/Coin/NFT)

Rights and interests

The liquidator will get 8% discounted (such as, repay 100USDT debt and get 108USDT collateral)

4. Abel Finance Project

A) Community Operation

B) Project Maintenance

C) Insurance Pool Operation

Last updated